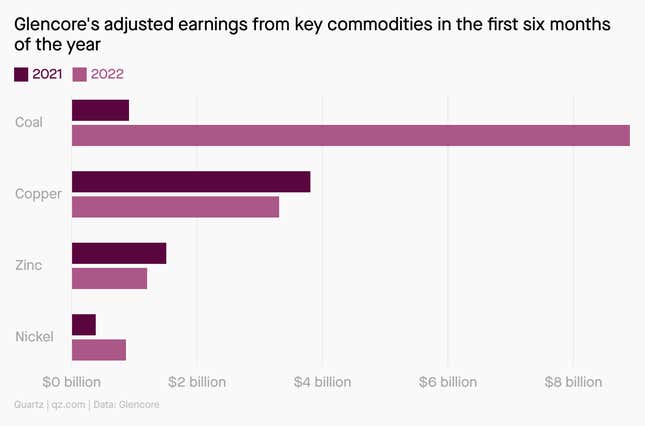

Glencore, the world’s top trader of coal, earned nearly $9 billion from the global economy’s dirtiest energy source in the first six months of 2022, the company reported on Aug. 4. That’s an 877% increase over the same period last year, thanks to surging demand for coal precipitated by Europe’s scramble to use less natural gas from Russia.

Germany, France, and other European countries are delaying the closure of old coal-fired power plants and redirecting their limited supplies of natural gas out of the electricity sector and into storage tanks, to be used to heat buildings in the winter. EU countries used 16% more coal for electricity in the first six months of this year than in the same period last year, according to the International Energy Agency (IEA). The sudden spike in demand more than tripled the per-ton price of coal. (Oil and gas companies also reported record profits for the second quarter as a result of Europe’s energy crisis.)

That spike was especially advantageous for Glencore, because it has stayed committed to coal production while competitors like Rio Tinto and BHP have gradually rolled it back. In April, Glencore shareholders approved a plan to keep its coal mines in operation until at least 2040. This flew in the face of overwhelming scientific evidence that coal consumption in wealthy countries must reach zero by 2030 to keep the global warming goals of the Paris Agreement in reach. But the decision is paying off handsomely for shareholders, who will pocket $8.5 billion in dividends and share buybacks this year.

For now, the world economy is moving in the opposite direction. Global coal demand in 2022 is on track to match the record set in 2013, according to the IEA. And depending on Russia’s gas export whims and the pace of China’s economic recovery from the pandemic, coal demand could even set a new record in 2023. Even if coal use falls off later in the decade, Glencore’s coal business looks poised for a luxurious ride into the sunset.