You won't know how lucky you are until you've driven a Volga.

The Supply Chain’s Inconvenient Truth

The entire world has turned their eyes to the “Supply Chain.” It is a term that seems rather intuitive and easy to understand on its face. We all buy goods. We all see Amazon drivers and UPS and FedEx drivers delivering packages. We think this is our easy future—same day delivery by Amazon, with prices ever-falling. Unfortunately, this “last mile” that we are so used to observing is only a tiny fraction of the entire Supply Chain. To truly understand the Supply Chain, one must understand the container. But the container—and the Supply Chain for that matter—are counterintuitive in our postmodern, post-industrial world.

As with all technology that we have grown up with, we are used to technology getting better and more efficient at an extremely rapid pace. We notice computers and computing power getting stronger, smaller, and cheaper all at the same time. We notice mattresses getting better, cheaper, and easier to deliver. It is embedded into our psyche—things always improve with time. We apply this same logic to all industries—including the Supply Chain. But this couldn’t be further from the truth. Our Supply Chain Industry has basically been the same since the container was invented in the mid-1950’s. Consumer expectations have increased exponentially in all facets of life, but our Supply Chain industry has remained flat, and unfortunately, brittle.

Americans represent the largest and most powerful consumer base in the world. This means we have more money and a stronger desire for material goods than any other population on the earth, at any other time in history. If you make and sell goods, the goal for your business is to gain access to this market—America. This, combined with the fact that even companies that are “American” decided 40ish years ago to not “make” their goods in America anymore, have contributed greatly to how Supply Chains around the world are designed. The reason was simple—cost. We began to offshore our production because overall it was cheaper, albeit much more complex.

Ultimately, what has led us to what many are calling a Supply Chain Crisis is demand. Businesses demand to make more money and people demand more stuff. At least in America.

What is the Supply Chain?

I’ve spent my entire professional career mainly in Supply Chain and Logistics. What is funny is that I wasn’t even aware of the industry until I was about 25 (I’m 33 now). I studied Civil Engineering, then pursued a JD/MBA. During my MBA, I was introduced to the industry. I say this because I assume most Americans are the same. They see “18-wheelers” on the road, and, if they live near a port city, they may see giant vessels coming in and out of the harbor, and everyone sees trains. But our only real interaction with the Supply Chain as everyday Americans is when we see delivery drivers dropping off packages. What we don’t see, or understand, is exactly how vast our import volumes are. Most Americans don’t truly understand how many containers filled with goods come into our country every week. The biggest vessels in the world now are large enough to put the Empire State building inside of them. Those boats show up every week at multiple ports. So much happens before that little cardboard box is dropped off on your porch. That is my industry. That is Supply Chain and Logistics.

I got my introduction into the industry through The South Carolina Ports Authority. I then went to work for the largest shipping company in the world, Maersk, and from there I got involved with Venture Capital, looking for innovative startups in Logistics Technology. Finally I landed in my current role at a company called Gnosis Freight where we provide international, container visibility software to retailers.

At Gnosis, we have access to every single container that is coming into the United States through a variety of different data sources. We analyze data from every possible provider—the ocean carriers, the ports, US Customs—and notify our customers where their containers are, when they should arrive, and when they are disrupted. Our company focuses on the “lifecycle of the container.”

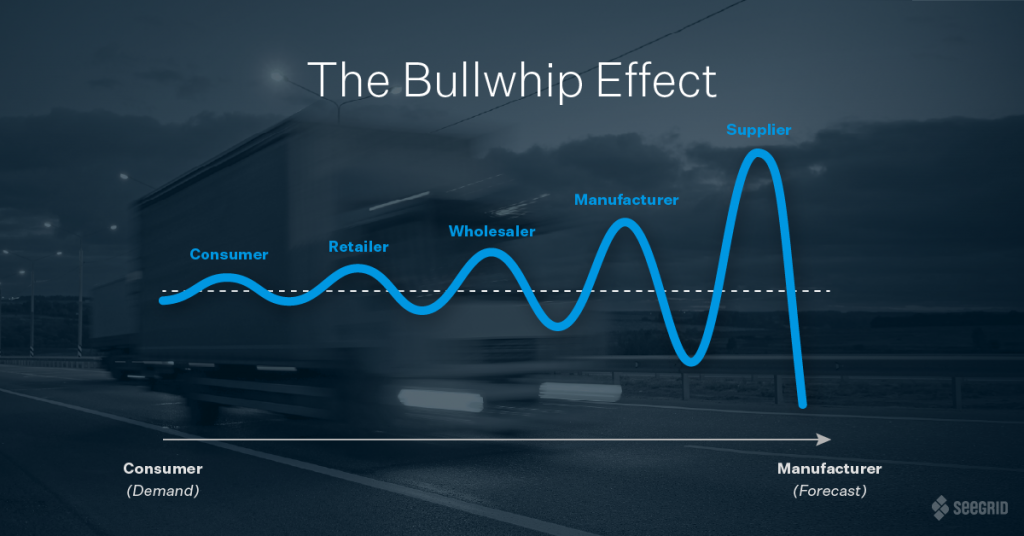

We watched the entire Supply Chain crisis unfold from the perspective of the container, and most importantly, we helped our customers adapt throughout 2020 and 2021. The problem, without a doubt, stemmed from the spike in demand. It initiated what we in the industry refer to as “The Bullwhip Effect.” In addition to The Bullwhip Effect, three additional constraints emerged—space (capacity), equipment, and labor.

Imagine swallowing a giant piece of steak without chewing it. What happens? Well, if you’re anything like me, it gets “stuck” in your throat. Then you take another bite without really thinking, because the steak tastes so good, and that next piece is also stuck behind the initial bite. By the time you realize you probably should have chewed your food better, you already have a little blocking in your throat. This is basically the Bullwhip Effect. And this is essentially how the Supply Chain Crisis of 2020-21 happened. To spoil the story, the only way to truly fix it is to wait. In the case of the steak, until it passes to your stomach; in the case of the Supply Chain Crisis, until demand finally tapers off and the goods become unclogged in the system.

Supply Chain is exactly that—a system. It is really a loose collection of a lot of different industries—ports, ocean carriers, rail companies, truckers, warehousing, customs, etc. Because of this, a container, on average, “changes hands” 20 times during its entire journey—most commonly from Asia to the United States. It is “handed off” between parties.

The system itself is overstressed. It is being asked to perform beyond its capacity with extreme constraints on space, equipment, and labor.

The Supply Chain also consists of legs and nodes. Legs are where the goods move. There are only four legs—ocean, air, rail, and rubber (trucks). The nodes are the static, handover points—factories, warehouses, ports, etc. The container journey starts when a purchase order is “cut” and the container is “stuffed” with goods at origin. It travels through all these legs and nodes until it reaches a distribution center in the United States. From here two things happen: 1) the goods continue their journey to their final destination (typically referred to as “last mile”); and 2) the empty container needs to be returned back to the port where it came from. This is the lifecycle of the container.

The international shipping container is intermodal. All legs and nodes, except airplanes, adapt to be able to carry, store, process, and move the standardized shipping container.

Furthermore, the Supply Chain is an “asset-based” industry. It consists of a tremendous amount of machinery and equipment. The goal is to keep these assets moving and working. Until the pandemic, this process, and the costs associated with it, were relatively normal and predictable.

The most important term to understand with regards to cost is a term known as “landed cost.”

Landed Cost = Cost to Make (manufacture) + Cost to Move (logistics).

When the containers are transported the way they are planned to move, costs are manageable and predictable. When things stop moving, costs go up. Every party pays a higher price when things stop moving. This is done to incentivize all parties involved to keep the goods moving. Keep the containers moving. Keep the equipment flowing. Keep the American consumer happy.

The Crisis

Keeping the American consumer is where our crisis began. We, the American People, ordered more goods than the entire supply chain industry could handle. This caught the entire industry off guard, and we collectively all swallowed the biggest, juiciest, most delicious piece of steak ever. And we didn’t chew it a bit.

This initiated the Bullwhip Effect.

When retailers realized that consumers were buying more goods than ever, they placed more orders than ever with wholesalers. When wholesalers received more orders than ever from retailers, they placed even more orders than ever with manufacturers. And when manufacturers received more orders than ever, they did the same thing and ordered even more from the suppliers.

The industry transitioned from a “Just-in-Time” methodology to a “Just-in-Case” one.

Enter The Bullwhip Effect. Each entity saw demand from downstream and ordered slightly more from their providers upstream, which resulted in a massive amplification that reverberated throughout the Supply Chain. This effect is somewhat common in the Supply Chain, and one of the jobs of an industry expert is to mitigate the Bullwhip Effect, but never really to this magnitude or with the constraints that emerged due to the virus.

What happened in 2020 was that the industry as a whole reduced capacity and shut down at the beginning of the pandemic. When the massive demand hit, the industry hadn’t started back up, and the capacity was already gone. Our bite of steak was huge, but effectively our mouth and throat were much smaller. The problem was much worse from the beginning. Demand “outstripped” supply, as we say.

This alone would have been enough to cause a crisis in the supply chain, but there were additional constraints that made the problem even worse. As mentioned, those were space (capacity), equipment, and labor.

Space was hard to come by. There was higher demand and not enough capacity. This made things extremely expensive. For everyone. There was limited ocean carrier space as the ocean industry attempted to catch up to inject more capacity, but that doesn’t happen overnight. “Injecting new capacity” is putting more boats in the water. Ironically enough, the ocean industry collectively had actually removed some capacity in January 2020 to help increase their rates. The unprecedented spike in demand, plus already limited capacity of ocean space, created a serious problem that took months to catch up. In order to secure space, the cargo owners/retailers started paying extremely high rates. Market forces took over, and the entire ocean carrier industry began charging up to 5x what they normally charge.

There has always been a trucker shortage. Today we are 80,000 drivers short, with tremendous pressure due to vaccine mandates of increasing that shortage by a lot.

Equipment also became hard to come by, such as containers and chassis (the frame and wheels that the container sits on when hooked to a truck.). Everybody was using the equipment to move the higher amount of goods. As with most goods today, the chassis are manufactured in China. The owners placed orders to inject more chassis capacity into the market, but since they are manufactured in China, they also are stuck in the problem they are trying to fix. The industry projects that the new chassis wouldn’t arrive until Summer 2022.

Labor was a nightmare. Not only were we dealing with shortages due to the virus, across the entire globe, but we were also dealing with labor unions and regulation at massive gateways/bottlenecks into our country (which I’ll speak more about below). This mainly was a problem at the Los Angeles/Long Beach (LA/LB) port system, where 40% of all goods into our country move through.

The Solution

Unfortunately, the only way the Supply Chain will normalize is when demand finally tapers off. Until then, we as an industry will continue to play catch up. The system itself is overstressed. It is being asked to perform beyond its capacity with extreme constraints on space, equipment, and labor.

To be honest, the great people in the industry are doing a damn good job. The truck drivers, port laborers, and logistics professionals are the best workers in the world. And our entire country rests on their backs. They don’t get enough credit. They want to show up, do their jobs, and get back to their families to live their lives. We need to get out of their way, while also working to remove unnecessary obstacles.

Unnecessary obstacles certainly exist, and the final analysis really is a two-pronged approach to solve this crisis. The first prong involves attempting to adjust the psychology and buying patterns of the US consumer. The second is a structural reformation of the existing policies that directly impact labor and regulation. While we can’t necessarily impact the first prong, at least not in a timely manner, we can definitely prioritize and influence the changes of antiquated policies that unnecessarily restrict the flow of goods and labor in our country.

Specifically, we can address the labor issue, which also is a union issue, as well as a capacity issue by addressing the “Jones Act” of 1920, which limits the types of carriers that can deliver goods within the United States. Under the Jones Act, an ocean carrier has to be “American” (built, crewed, and flagged in America) in order to deliver goods via ocean. For example, currently you cannot deliver goods via ocean from LA to Seattle unless that vessel meets the requirements above. Today, there are no global, American-owned ocean carriers. By revisiting the Jones Act, we could relieve some of the inland pressure that occupies a lot of the capacity for our trucks and trains. The existing capacity could be re-allocated to help alleviate pressure at the ports.

In addition, by addressing the union labor issues, we can re-align incentives while also preventing the unnecessary disruptions from savvy union labor negotiations at inconvenient times. Fortunately, this isn’t a theory. We have real-world examples both here in the US as well as abroad, as to what the optimal port operations model is. In Charleston, the base salary for the crane operators is roughly $70k/year. The highest-grossing crane operator took home $170k because the crane operators are paid for every container they take off the vessel. One thing it definitely does not include is a highly unionized labor force.

For example, in the United States, the Ports of Virginia and the South Carolina Ports Authority both have performed well amidst the crisis. In Virginia, automation has been the solution. In South Carolina, the non-union labor force has been the answer. Additionally, both operate monolithically with regards to their governing structures. They are quasi state-owned entities that operate off their own revenues. Minimal friction with regards to governance, properly incentivized with regards to labor, and insulated from unnecessary labor disruptions is the obvious way forward.

While we may not be able to change the US consumer appetite for goods, we can at least enact policies to help minimize the three additional constraints—space, equipment, and labor. This can be done immediately by allowing as many of the laborers to compete in the markets without unnecessary burdens while also assisting on the space and equipment side with actual financial assistance on assets—chassis, infrastructure, and creative incentives for carrier capacity.

Once the demand tapers off, the system can be reengineered to be more resilient. It is a long time overdue to be honest. Until then, we are stuck. Literally.