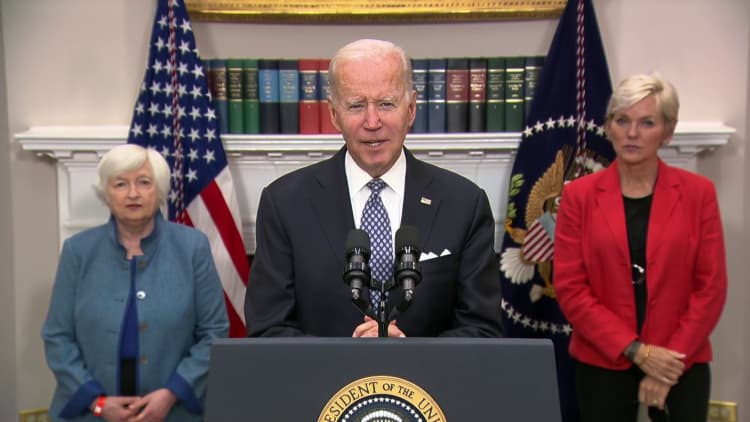

President Joe Biden threatened Monday to pursue higher taxes on oil company profits if industry giants do not work to cut gas prices.

Biden has criticized oil companies that have made record-high profits as consumers struggle to keep up with high gas prices. The price of a gallon of gas was $3.76 on Monday, according to AAA, down from a record of over $5 in June but still higher than a year ago.

"Their profits are a windfall of war," Biden said, referring to Russia's war in Ukraine, which prompted Western sanctions that reduced oil supply. "It's time for these companies to stop their war profiteering."

"If they don't they're going to pay a higher tax on their excess profits," he said.

With eight days to go before Election Day, White House messaging has focused on how Democrats are working to improve the economy and how Republicans would make it worse. Inflation and the economy consistently rank as the top issue for voters — and higher gas prices stretched consumer budgets for much of this year.

Ahead of the election, he has highlighted efforts to reduce consumer costs in a range of other industries. Last week, Biden announced initiatives to address "junk fees" from banks, airlines, cable companies and other industries, aiming to "provide families with more breathing room."

Any new taxes on oil profits would need congressional approval, which may prove difficult as Democrats control both chambers of Congress by slim margins. Progressives like Senators Bernie Sanders of Vermont and Elizabeth Warren of Massachusetts previously floated the idea.

Republicans, who generally support lower taxes, also hope to win back one or both chambers of Congress in the Nov. 8 midterms.

Biden stressed that he is "a capitalist" but added that companies are making "profits so high it's hard to believe."

Shell made $9.5 billion in profits in the third quarter, almost double what it made in the same period last year, Biden said. Exxon's profits in the third quarter were $18.7 billion, nearly triple what Exxon made last year and the most in its 152-year history.

Biden has made pleas to oil companies to increase production rather than to enrich shareholders in recent weeks as the price of gas remains high.

Earlier this month, Biden announced the release of 15 million barrels of crude oil from the Strategic Petroleum Reserve. The White House has released about 165 million barrels of crude from the reserve since the beginning of the year, out of a total that it said would be around 180 million.

Biden promised in his earlier speech to purchase oil to refill the reserve once the price hits $70 a barrel. He said companies should therefore invest now in increased production with the confidence that the government will purchase the oil later.

Mike Sommers, the president and CEO of the American Petroleum Institute, an oil and natural gas trade association, said in a statement the Biden administration was taking the wrong approach.

"Rather than taking credit for price declines and shifting blame for price increases, the Biden administration should get serious about addressing the supply and demand imbalance that has caused higher gas prices and created long-term energy challenges," Sommers said. "Oil companies do not set prices — global commodities markets do. Increasing taxes on American energy discourages investment in new production, which is the exact opposite of what is needed."